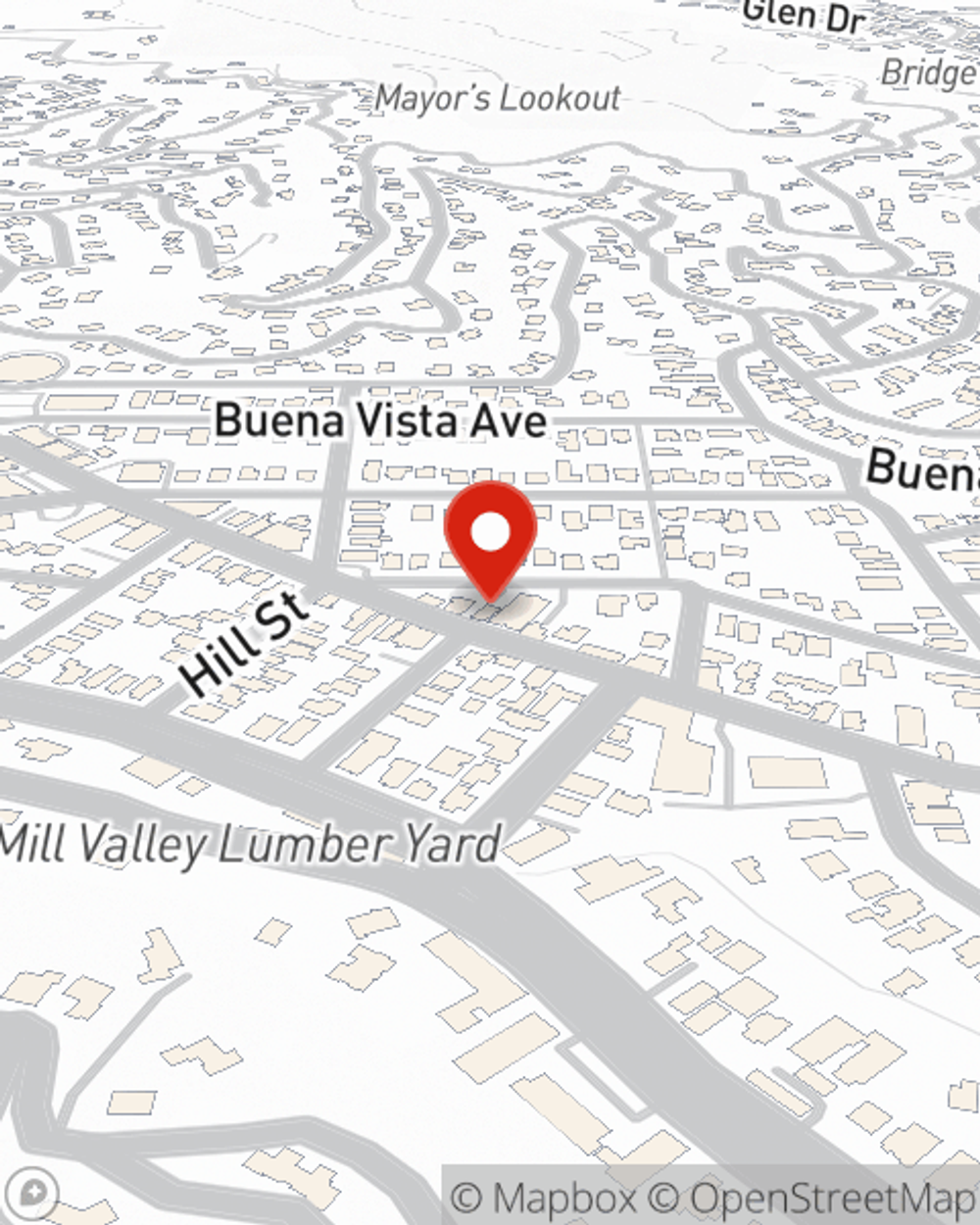

Life Insurance in and around Mill Valley

Life goes on. State Farm can help cover it

Life won't wait. Neither should you.

Would you like to create a personalized life quote?

Be There For Your Loved Ones

State Farm understands your desire to care for your loved ones after you pass away. That's why we offer fantastic Life insurance coverage options and dependable considerate service to help you choose a policy that fits your needs.

Life goes on. State Farm can help cover it

Life won't wait. Neither should you.

Life Insurance You Can Trust

When choosing how much coverage you need, it's helpful to know the factors that play into the type and amount of Life insurance you need. These tend to be things like the age you are now, your health status, and perhaps even occupation and personal medical history. With State Farm agent Shere Goo, you can be sure to get personalized service depending on your specific situation and needs.

Looking for a life insurance option that even those who thought they couldn't qualify could benefit from? Check out State Farm's Guaranteed Issue Final Expense. It can be helpful to cover final expenses, such as medical bills or funeral costs, without overwhelming your loved ones. Contact your local State Farm agent Shere Goo and see how you can be there for your loved ones—no matter what.

Have More Questions About Life Insurance?

Call Shere at (415) 383-8437 or visit our FAQ page.

- Build a stronger well-being.

- Get guidance and motivation to strengthen key areas of your overall wellness.

- Explore estate and end-of-life planning tools.

Simple Insights®

Do stay at home moms & dads need life insurance?

Do stay at home moms & dads need life insurance?

Even when an adult family member doesn’t work outside the home, life insurance is still worth considering.

Simple Insights®

Do stay at home moms & dads need life insurance?

Do stay at home moms & dads need life insurance?

Even when an adult family member doesn’t work outside the home, life insurance is still worth considering.